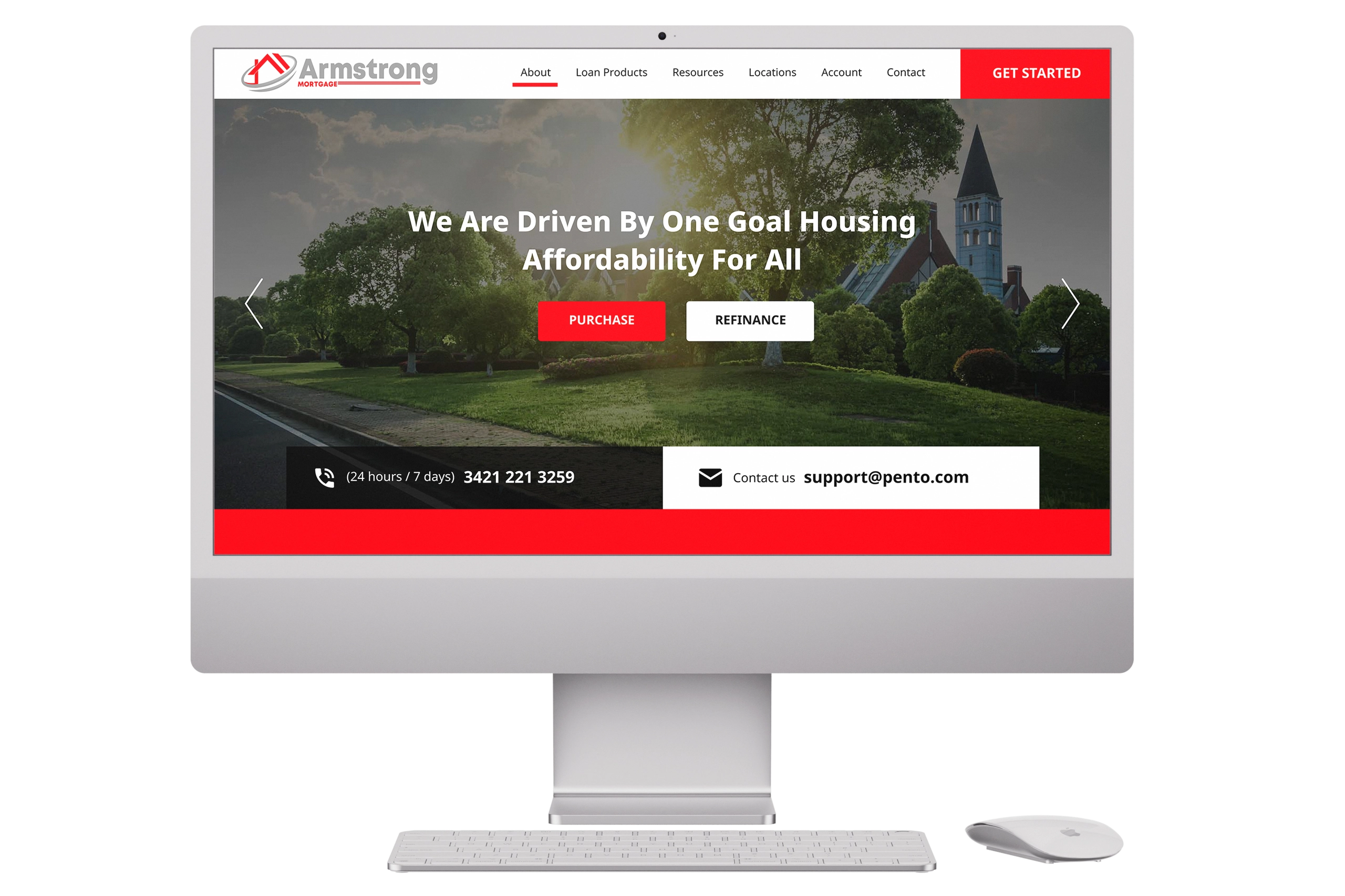

Armstrong Mortgage – Digital Loan Origination Platform

Project Overview

The Armstrong Mortgage website serves as a comprehensive online platform, streamlining the mortgage process for users. It provides valuable resources such as information on different mortgage products, up-to-date rates, and convenient payment calculators. Visitors can easily educate themselves about various loan options, initiate applications, and access contact information for inquiries, all in one user-friendly destination. Whether you’re a first-time homebuyer or an experienced investor, this website offers a wealth of information to make informed decisions about your mortgage needs.

Armstrong Mortgage is a fintech platform designed for mortgage applications and loan processing. It simplifies borrower-lender interactions while automating compliance, underwriting, and approvals.