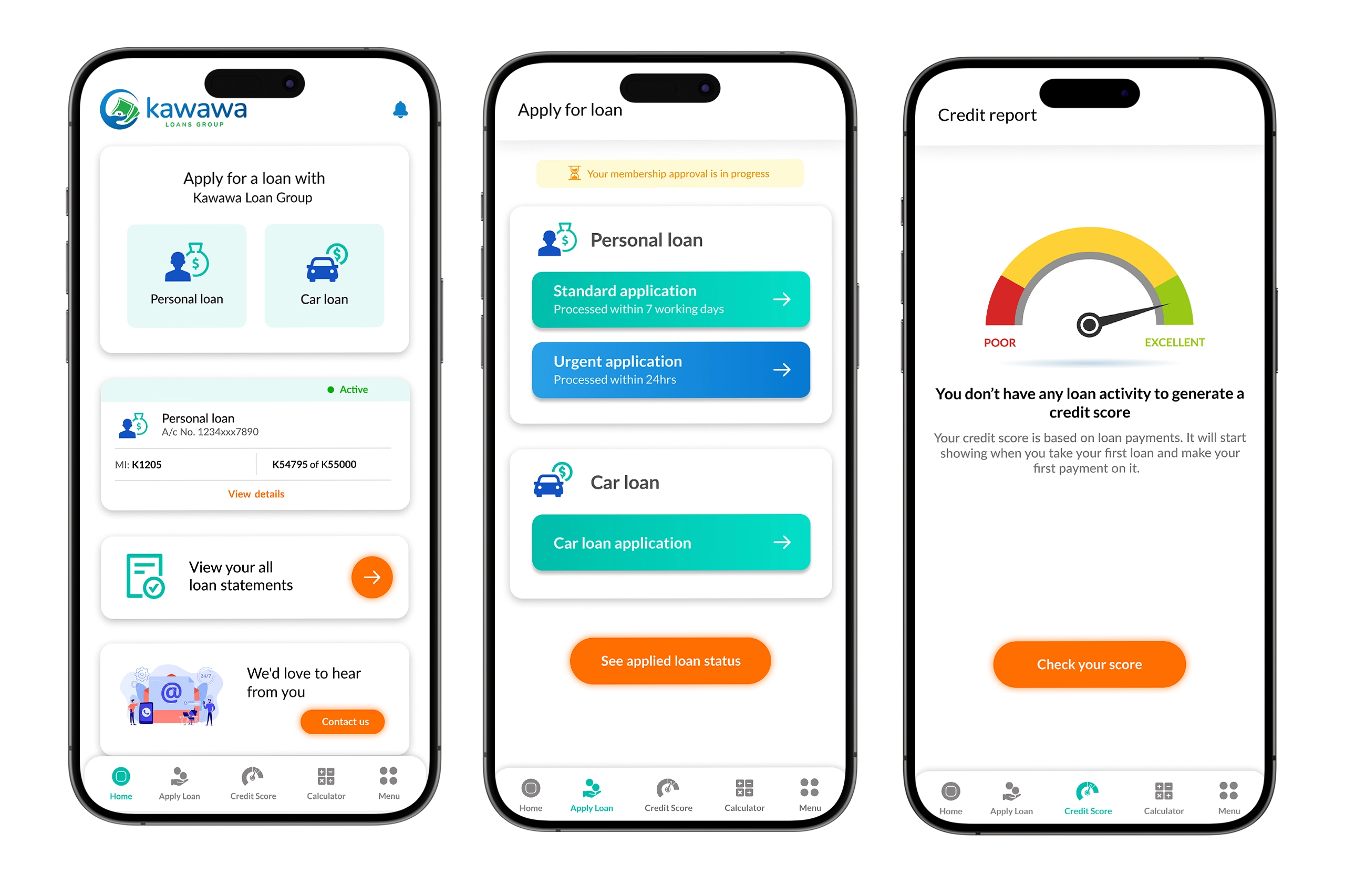

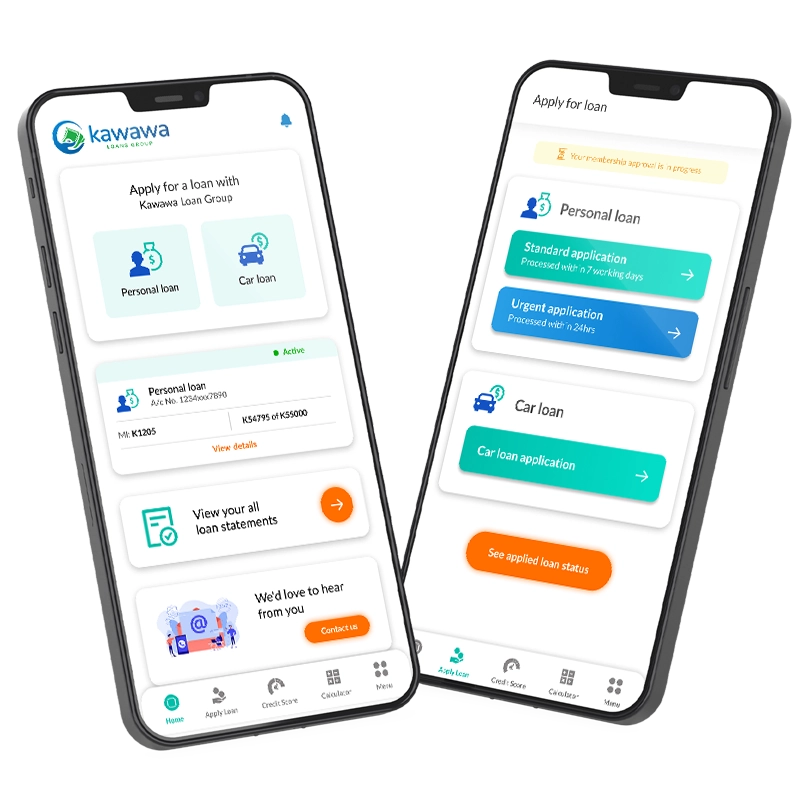

Kawawa Loan – Digital Lending & Credit Management

Project Overview

Kawawa loan application is a software tool designed for smartphones that provides a convenient and accessible way for users to apply for various types of loans, such as personal loans, mortgages, or small business loans. These applications typically offer features like a user-friendly interface for submitting loan applications, document uploads, credit checks, and approval processes. Users can also use these apps to manage their loan accounts, make payments, track their repayment schedules, and receive notifications and updates related to their loans, all from the convenience of their mobile devices.